Welcome, everyone.

I’ll begin by reviewing recent decisions and actions we are taking to reduce our operating expenses and cash burn enabling us to weather the current market conditions while still delivering on the important product launches that will deliver significant shareholder value. Beginning in Q1, our leadership team began working on a reprioritization of our product investments to identify ways to reduce our cash burn, while preserving the important, short term value creating programs. That reprioritization was completed in Q2 and allowed us to right size the resources required to deliver on the new priorities as we enter the second half of 2022. The resulting savings are expected to reduce our headcount carrying costs by more than $4.5M when annualized. When combined with the operating savings from the reprioritization process, reduced headcount and the eminent monetization of some of our assets through licensing and strategic activities, we anticipate being able to reduce our annual operating costs by over $12M over the next year and have improved line of sight to how our cash will last into 2024, while still allowing us to deliver on VitaGraft™, DetermaIO™ and DetermaCNI™ product launches.

In order to allow us to divide and conquer with a leaner organization, I am happy to announce that Gisela Paulsen has been promoted to President and COO and Anish John has been promoted to the role of CFO from his previous role as interim! These moves will allow me to focus on corporate business development and Investor relations while they operate the company day to day. Both promotions are well deserved, and I look forward to working with this core team to deliver OCX through the current market storm and emerge as a leaner, focused company delivering products that fulfill our mission!

I would like to start today’s progress update discussing our compelling revenue opportunity in transplant rejection monitoring. For those that have been following the story since our acquisition of Chronix Biomedical, you will also notice we have rebranded the test from TheraSure to VitaGraft…branding we believe is more reflective of the intended use in Transplant.

As you likely recall, last fall we set out to complete the technical transfer of the test from our German R&D team into our CLIA lab in Nashville and then validate our laboratory test for liver patients with an ambitious goal for the end of the first half of 2022. I’m very proud of the focused effort by our CLIA lab team and the Transplant R&D team in Germany for their combined effort to deliver on this important milestone ahead of schedule in early April!! This expedited effort also allowed us to complete the clinical validation required to submit our dossier to CMS for Liver reimbursement which we accomplished in late April. We then followed that submission with our Kidney dossier in late June! With our liver test now clinically validated, we have entered our Early Adopter Program phase of launch and have already signed on one of the largest liver transplant centers in the US who will begin sending our first samples later this month. The responses from key opinion leaders have been resoundingly positive…Since today there is no routine molecular monitoring test in use to monitor for rejection of a transplanted liver, we are encouraged by the KOL interest and believe our test will become very important to the liver transplant community.

Our vast experience in PCR has allowed us to develop a streamlined workflow delivering an incredibly efficient digital PCR application that allows us to consistently process and report patient monitoring results within 1-2 days at launch. We have now confirmed with numerous KOLs in liver that our turnaround time is indeed expected to deliver the fastest donor-derived cell-free DNA monitoring results in the industry. This of course is something we set as a goal in our test workflow redesign and a product attribute that we believe will differentiate Oncocyte from the competition.

We have also made progress on the IVD process for creating a kit to democratize the transplant market and will soon begin development of a kitted version of the monitoring tests across Liver, Kidney, and Heart. We are fortunate to have several instrument systems that work with our assay and are working with the best platforms through feasibility to ensure we have the best results and cost position for our democratization commercial efforts. For strategic reasons, we will not be speaking specifically about our potential instrument partner’s platform performance until we are ready to publish and announce the data, but we are on track for completion of feasibility and trial initiation by early 2023.

There are several milestones to watch for over the coming months as we commercialize our Vitagraft products.

- First, we will continue to onboard KOL’s from the Liver Transplant community as part of our Early Adopter Program

- Second, we expect reimbursement decisions from CMS this fall

- Third, we expect to initiate our full Market launch of Vitagraft Liver and Kidney in Q4 once reimbursed and,

- Fourth, we plan to complete platform feasibility for the IVD kit product by end of year and site enrollment for the clinical trial to commence in early 2023.

Now, let’s turn next to our flagship oncology program, DetermaIO.

To remind you, this is our gene expression test to help physicians assess tumor microenvironments to determine which patients are suitable candidates for immune-oncology therapies. Our early adopter program continues to underscore to us the need for this test across a slate of cancers.

Previously, we have shared the valuable insights as to the importance of the DetermaIO test in early-stage triple negative breast cancer and Late-Stage non-small cell lung cancer. We now have solid data from various meetings, including results from the NeoTRIP randomized trial in TNBC presented at ESMO last fall. Then, in the second quarter, at AACR, we presented data supporting its use in metastatic bladder cancer, our third tumor type, and have now had our peer reviewed paper accepted for publication! We see this as a major milestone and feel well-positioned as we prepare DetermaIO for CMS submission for reimbursement.

Adding to our growing data sets, In June, at the American Society of Clinical Oncology (ASCO) meeting, we released results from the GONO clinical trials group where DetermaIO was tested as a biomarker on the AtezoTRIBE study. As a reminder, AtezoTRIBE is a randomized clinical trial in metastatic colorectal cancer where patients received placebo or the standard of care, plus the Roche drug Atezo. If you haven’t had a chance to review the data and the subsequent comments from the AtezoTRIBE principal investigator, I encourage you to do so. The key takeaway is that DetermaIO found a new patient population in metastatic colorectal cancer that no other biomarker found and today, these patients are not eligible for immunotherapy! DetermaIO is expected to expand the market for ICI use in mCRC and may allow for enrollment of a whole new population of patients into a lifesaving treatment protocol!

Also, at ASCO, we released data on DetermaIO in metastatic triple negative breast cancer, or TNBC, patients using the Merck drug Keytruda. The data presented at ASCO confirmed the previous data sets findings… DetermaIO has demonstrated superior accuracy to predict response to ICI therapy and is agnostic to which branded immune checkpoint inhibitor a physician uses.

Finally, at ASCO we released new data in gastric cancer, the third leading cause of cancer-related deaths outside of the US. We feel that this indication is important now that we have solidified our platform and channel partnership for rest of world markets and are already working on the kit version of DetermaIO.

DetermaIO has now been validated in over 1100 patients, in six tumor types and across all four major Immunotherapies!! Our Early Adopter Program continues to provide valuable use cases for CMS submission and market launch, and our volumes have continued to double each quarter during our limited launch. EAP Clinicians are reordering the test for multiple use cases across multiple tumor types, and we remain incredibly enthusiastic about the future of DetermaIO.

In Q2, we also began refining the priorities for our kit strategy with our platform partners. We made a decision to focus these relationships on short term ROI projects that require less investment but still have significant market impact. The two product efforts we have settled on are a kitted version of DetermaIO for submission for regulatory approval in the EU and ultimately, the US, and our VitaGraft Digital PCR Transplant Monitoring test for liver and kidney for US FDA submission. We have already initiated the work to move both projects forward to keep us on track to meet the timelines we have set for our IVD development team. We look forward to updating you on our progress in this incredibly important strategic effort in future calls.

Despite the ongoing macro-environment challenges in the second quarter, we made solid commercial progress with DetermaRx™, our lung cancer stratification test. Since its launch in mid 2020, DetermaRx has now touched well over 1100 patient’s lives…these patients had stage 1 tumors and without our test information, may have gone untreated and statistically, half of them may not be with us now. Recently, we were introduced to one of the first patients to utilize the test when it was first developed and in use prior to Oncocyte’s acquisition. Jamie was only 34 years old when diagnosed with early-stage non-small cell lung cancer. Jamie told us that her greatest fear at the time was not being able to be there for her kids, not being there for their milestones and seeing them grow up, and not being able to grow old with her husband and see her grandkids someday. Her surgeon ran DetermaRx to see if she was high risk for a recurring tumor. When it came back positive, she didn’t hesitate to opt for the single round of chemo. Today, Jamie remains cancer free, enjoying life with her family, celebrating anniversaries and graduations and is a fantastic advocate for DetermaRx. She believes every early-stage lung cancer patient deserves to know if they are high risk for recurring metastatic disease, and it is stories like hers that inspires our team to continue on our mission. I encourage you to watch Jamie’s story on our website. DetermaRx is now standard of care in large lung cancer surgical programs like Florida Oncology and continues to gain momentum in its usage!

I’m pleased to report that in the second quarter, DetermaRX, sample volumes were 66% above prior year driving towards our stated goal of doubling 2021 volumes and revenues in 2022. We also were able to expand our pool of on boarded physicians, which now number 549 practitioners, up 16% year over year.

In sum, we are really pleased with the traction our small but extremely effective sales team has secured, and of course thrilled that Oncocyte is positively impacting treatment plans and outcomes for lung cancer patients.

In closing, I want to reemphasize that when you combine the cost reduction activities, I mentioned earlier with the anticipated attractive gross margins of VitaGraft and DetermaIO revenue streams in 2023, you can start to understand our confidence in our ability to bring Oncocyte through the challenging environment leaner and stronger.

Some Key revenue-based milestones to keep an eye on for the next 6 months include:

- The anticipated receipt of reimbursement for VitaGraft and the subsequent full market launch of our laboratory developed test

- Expected submission of DetermaIO and Tx for reimbursement

- And, planned monetization of assets through Strategic licensing of our Tissue based assays

I am grateful for your support as we advance our products through the various development cycles to deliver on our mission.

At this point, I would like to turn the call over to Anish John to review our financials. Anish?

Anish John

Thanks Ronnie and hello everyone.

Our consolidated revenues for the second quarter of 2022 were approximately $2.1 million up $0.7 million quarter over quarter and a slight increase as compared to the same period a year ago.

Second quarter revenues associated with DetermaRx were $0.8 million, down $0.2 million sequentially, and up $0.2 million year over year.

We received $1 Million in licensing related revenues in the second quarter from the final Burning Rock milestone payment.

Our Pharma Services business generated $0.2 million in the second quarter, a decrease of $0.1 million quarter over quarter, and an increase of $0.1 million year over year. As we have discussed previously, revenues in Pharma Services depend on our partner’s ability to enroll patients for trials which continue to face headwinds and will likely continue to fluctuate from quarter to quarter.

We do have a pipeline of work from our diagnostic development partners Qiagen and Thermo Fisher which we believe will grow and be more predictable in future quarters.

Cost of revenues for the second quarter were approximately $2.4 million, including $1.4 million from the cost of diagnostic tests and testing services we perform for our DetermaRx and pharma services customers, providing revenue deliverables under our license agreements, and $1.0 million in non-cash amortization expenses of DetermaRx and Pharma Services-related intangibles.

Research and Development expense for the second quarter 2022 was $5.6 million, an increase of approximately $3.0 million from the same period a year ago. The increase in R&D expense was related to site startup costs for our PADMA trial for DetermaRx, and headcount as we prepare to begin the IVD development in order to kit DetermaIO and VitaGraft Liver and Kidney to fulfill our platform partnerships. We also continued R&D activity to support ongoing clinical trials to gain statistical power to our current DetermaIO data sets to ensure success as we submit to CMS for reimbursement. Additionally, we completed the CLIA validation for our new VitaGraft product offering in preparation for the Q3 launch of our new transplant business.

Sales and Marketing expense for the first quarter of 2022 was $3.5 million, an increase of $0.9 million year over year, primarily attributable to an increase in headcount and continued ramp in sales and marketing activities to prepare for commercialization of our transplant business as well as support the commercialization efforts of DetermaIO and DetermaRx.

General and Administrative expense for the second quarter of 2022 was $5.5 million, a decrease of $2.4 million for the same period in 2021, primarily due to one-time acquisition related costs of the Chronix Biomedical acquisition in the same period of the prior year.

Excluding this one-time prior year cost, General and Administrative expenses were maintained year over year inclusive of increases in stock-based and cash compensation for our new hires, and a standard Cost of Living increase for many employees.

Non-GAAP operating loss, as adjusted, for the second quarter of 2022 was $11.2 million, an increase of $3.4 million as compared to the same period a year ago.

GAAP operating loss, as reported, for the second quarter of 2022 was $8.6 million, a decrease of $1.3 million quarter over quarter and a decrease of $5.0 million as compared to the same period a year ago.

We have provided a reconciliation between these GAAP and non-GAAP operating losses in the financial tables included with our earnings release.

For the second quarter of 2022, we reported a GAAP net loss of $8.3 million, or $0.07 cents per share, as compared to $10.3 million, or $0.11 cents per share, a decrease of $2.0 million quarter over quarter, and $10.5 million, an increase of $2.2 million as compared to the same period a year ago.

Turning now to the balance sheet, as of June 30th, 2022, we had cash, cash equivalents, restricted cash and marketable securities of $47.1 million. Early in the second quarter, we raised $32.8 million in net proceeds from an underwritten offering of common stock, priced at market.

We received the first of two $5M tranches of preferred stock offering proceeds in the second quarter, with the final tranche expected in the fourth quarter of this year. Additionally, we are currently reviewing several options for non-dilutive forms of capital including capital lease lines, and licensing tests in ex-US markets as well as commercial partnerships and the monetization of certain assets. We feel confident that our current balance sheet combined with these non-dilutive opportunities provide us with sufficient cash to take the company into 2024. Over the first half of 2022, we have proactively prepared for continued market headwinds and reprioritized our investments in our product portfolio by focusing on shorter term revenue opportunities and instituting a more sequential approach to product development and test launches. Specifically, we plan to reduce the number of clinical studies we invest in over the next 18-24 months and rely on the data collected to date to support the submission for reimbursement and any subsequent product launches. We also plan to re-evaluate timing of several capital-intensive investments including the planned sales force expansion to launch DetermaTX and DetermaIO. The expense reductions combined with the anticipated revenue growth once our tests receive reimbursement is expected to have an immediate impact on reducing our cash burn. Since the end of the first quarter, we have right sized our organization to match the more focused priorities and have taken a definitive step to reduce our headcount carrying cost by over $4.5 million on an annual basis. In Q3 we expect to incur a severance charge of approximately $2 million as a result of these actions.

Net cash used in operations for the quarter was $11.3 million. Net cash used in operations decreased sequentially due to focused efforts to control hiring and optimize our use of cash primarily by reducing clinical trial spend and marketing investment beyond the $1 million milestone payment from the Burning Rock licensing agreement.

In summary, Management has taken numerous actions in the first half of 2022 to focus investments and reduce our cash burn without impacting the long-term potential enterprise value of Oncocyte. In future quarters, we expect to benefit from the anticipated wind down of several studies and trials, the rightsizing of the organization to better match the new prioritization and revenue growth from our high margin, and major product launches planned for the coming quarters. We remain confident that the combination of these activities will allow us to enter the first half of 2023 with a quarterly cash burn rate below $10 million and we expect the burn to decline to or below $8 million by the second half of 2023. We are committed to weathering the current market headwinds with a well-constructed plan that we believe will position us to deliver on critical product launches over the next 6-8 quarters.

That concludes my remarks concerning our financial highlights.

1. David Westenberg of Piper Sandler:

1a. Hi, thank you for taking the questions. I really liked all the color here on the transplant, the incremental submits, this all the way to commercialization. So can you just give me some color or maybe rank order what's under your control versus kind of what's out of your control? And I'm just trying to think about what could go wrong in terms of the things that are outside of your control?

1b. And then sticking with that liver and kidney thing, you submit it at two different timeframes, do you expect to receive reimbursement at the same time or is that going to be laddered the way you reimburse?

Ron Andrews:

Yeah, David, great questions and thanks for those. Let me start with the last one first. I think it'll be easier. We knew that liver today does not have any test covered to date. And even though the LCD was written as a somewhat of a blanket LCD for kidney and heart, I know those are established pricing at about $2,700 to $2,800, we knew that liver had not been through that process.

And so we wanted to bring liver in early so that we could submit liver and go ahead and get the first round of questions which we have already received and have already begun responding to. So we received those questions last week, we are answering those questions this week, and we expect to have the return of those questions back to CMS next week.

We'll always get some questions, so we expect kidney as well. We'll have some follow up questions, but we don't expect them to be as intensely centered around... which is where the liver questions were mostly centered.

And so it's important that we have our KOLs. They’ve been very kind, gracious and very excited about what we're doing in liver and they'll be part of our response on the utility, but we don't expect kidney to have as many of those types of questions. And so we submitted them, liver first and then kidney, hoping that we end up somewhere in the September, October timeframe getting responses for both.

But you asked what's in and out of our control. I mean, what's in our control right now is we've redone the workflow, it is ... I've been doing PCR for a long time since we incubated it in water bath. And I'm really excited about our team and what they put together. This is a really, really solid workflow.

Our CLIA lab workflow in the lab is well less than a day and so it's the logistical parts around that push it over a day. So we're excited, we can control that. What we can control is the outreach we had to the current high value targeted liver centers, which response has been very solid there. We can control, obviously, ourselves launching this and how we actually execute on the test performance.

What we can't control, as you've already mentioned, is the timing for CMS. And under the blanket LCDs, you guys are well aware of this, but just for everyone on the call. Under a blanket LCD, typically there is a timeframe of 60 to 90 days when you get the review, and you get your questions, and you get an answer.

But given how backed up Palmetto is and just given the current environment, we did see those questions for liver come in within the timeframe they committed, so we're hoping that we're on those timeframes, but obviously we can't predict those timeframes. So hopefully that's a good thorough answer, David, but that's what we're focused on is execution. And we just hope that when CMS can respond as soon as they claim they want to, so.

David Westenberg:

And then maybe let's go back to the liver. 'Cause that answer implies it's on a different timeline. So after submission, I mean, it's not the 60 to 90 days…

Ron Andrews:

Yeah, I think you get 60 days.

David Westenberg:

... half the time.

Ron Andrews:

... 60 days. They typically answer you with the first round in 60 days, then you have a chance to respond and then they have another 60 days from that point. And so we got their answers, we're very happy that they got them to us at the timing they did for liver. We're answering our questions this week, they'll get them back next week and so somewhere 60 days from next week we hope to hear back from them if not sooner.

David Westenberg:

1c. Got it. Okay, I appreciate it. And then I ... You touched on some changing of roles here. I believe you said that your everyday ... You're going to be kind of backing away from everyday operations? Just want to confirm that I heard that correctly. And can you maybe take another layer back in terms of what that means other than just kind of investor relations and biz dev kind of outlook? Can you talk kind of a little bit more about your day to day?

Ron Andrews:

Absolutely, David. I don't want anyone to get the impression I'm not going to be very active. I am very active. But we're at a point where we have an incredible operating professional in Gisela Paulsen. She came with all the experience she had from Roche, and Genentech, and Exact Sciences years. She's been here since the fall and we're at a point where from project management, program management, internal operation, lab oversight, and all that, she can take on a lot of what I was doing that frees me to do more corporate development work, more time with investors, and certainly more time with strategy and some things that are important. It gives me more time to be in the field.

I'm personally going to oversee the transplant launch and program since I have so much product launch experience. I'm old and I've been doing this a long time. I've launched a lot of products in the PCR world, so I'm going to be very active with that.

And so having Gisela step in to sort of manage the ... As COO, she was already doing most of the operations, but she'll take on a little bit more now and then I'll get to go do more focus on growth of the company and execution around revenue generating opportunities.

And Anish, obviously we're very excited. He stepped into the interim role for a couple months and he loved what he was doing and we loved having him. So he is now going to step in and be full-time CFO which we're all very grateful for. He has an incredible background in operating finance which is what we need as a company right now.

David Westenberg:

Got it. All right, I appreciate it.

David Westenberg:

1d. Did I hear on DetermaIO, it's a little bit delayed because you need that power, you need more patients. I don't know if I heard that correctly in the prepared remarks or not. Maybe I misheard that. Can you just clarify-

Ronnie Andrews:

Sure. Let me clarify. DetermaIO is on track to submit this fall. We have it powered and we believe in three tumor types. We are waiting on the acceptance of these data in a peer reviewed publication. That's the last criteria that we have to check, the box you have to check before we can submit.

Those manuscripts are out. We've actually had one accepted and so we are hoping to see the other two for non-small cell lung and for triple negative get accepted as well. And once those are all three bladder, TNBC, and long accepted, we'll go. So we don't need any more statistical power necessarily, we'll always want more statistical power.

But we are ready for that. I think the message that we sent last quarter and David, just so you guys as you think about modeling, we're going to go to market with those three indications. We did have a really superior output in colon at ASCO and we're following up with lots of different opportunities there, but we will need to get more data on the colon before we can submit a paper and then add that to the list.

David Westenberg:

Got it. I appreciate it. Thank you very much and I'll opt out of the queue.

Ron Andrews:

Thanks, David.

2. Mike Matson of Needham & Company:

2a. Yeah, thanks for taking my questions. I got a few on VitaGraft. So in terms of when you actually launch it, I guess first it's going to be kind of a CLIA test that you're doing in your own lab and then you'll eventually have a KITed version?

2b. Do you think there's going to be a difference in terms of how the sales or the rate at which they ramp for the CLIA offering versus the kit offering?

2c. Is it going to be kind of limited in the early days when you're going to do it yourself and then really take off the kit? Do you think you could take off pretty strongly just with the initial launch?

Ron Andrews:

Yeah, the feedback we've gotten from the market is there is no one using liver. Thanks to a couple of the pioneering companies that have sort of created the market in kidney and heart, we benefit from the overflow, if you will, of people knowing how to use these types of tests now in liver.

And so when we did our outreach, we got some very positive feedback from some very high profile centers. And so our goal in, right now, the early adopter phase Mike, is to get as many of those sites onboarded as we can to really play through our logistics, our turnaround time in our lab. And we'd, ultimately, like to get it to within a day or within 24 hours, but that's going to require overnight shifts and logistics that today we're putting in place, but we haven't tested yet.

And so, ultimately, we think that once we're ready to go full market, hopefully by October, November, when we get reimbursement, the idea would be that we would open it up to all centers of liver. And assuming we get kidney, obviously that's a very competitive market. We'll do our best to go after the kidney market.

I think the real opportunity for us, though honestly, we'll create a nice business as a lab developed test product. But the participation in economics that are afforded by democratization to the transplant centers themselves and to pathology labs serving transplant centers are significant.

And the turnaround time plus those new economics that they don't receive today, because as a central lab we get those economics, sharing those economics, we do expect that and all our market research says that will be the sort of the catalytic event for market growth for our KITs. And so we'll see how that goes, but we are planning on going full board with liver and that we do expect a rapid revenue ramp in '23 into '24 on liver before we get to a KITed product.

Mike Matson:

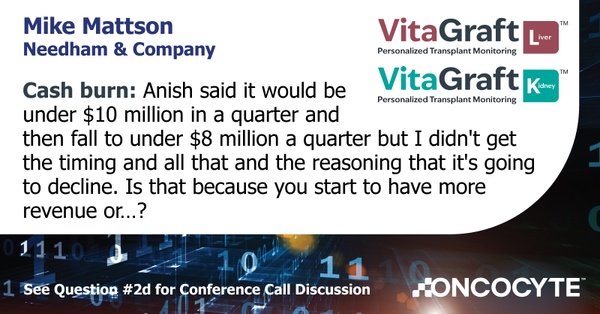

2d. Okay, got it. I just had a question on something that Anish said on the cash burn. So I think he said it would be under $10 million a quarter and then fall to under $8 million a quarter, but I didn't get the timing on all that of the reasoning that it's going to decline. Is that because you're going to start to have more revenue or? I apologize, went through a little quickly there.

Ron Andrews:

No, it's fine, it's a combination. I'll let Anish give the call a commentary. It's actually a combination of reductions in head count that we made recently, re-prioritization of projects, and we defunded some things that we were funding. We're winding down some clinical studies now so that we can ... I think you guys know this, and I've had conversations with most of our analysts who follow us. You don't just go and plug these studies, 'cause these are very high profile accounts, very high profile key opinion leaders who want to complete the study and then publish.

And the last thing we want to do is ... We have a very, very solid brand of high science amongst the oncology community today, and the last thing we want to do is ruin that. So we are going to continue the current trials that we have going on in studies. Those will bleed off over time as you head into next year.

So the combination of that with the reduction headcount, with some prior decisions we've made will reduce it to about a $12 million operating expense reduction. And then from there, you add revenue on top of that and that revenue, even nominal revenue that we've modeled, takes us under $8 million in burn as you enter the second half of 2023. Anish, any comments on that?

Anish John:

Yeah, and just to confirm the timing also, the under $10 million burn rate record is really in the first half of 2023. Just so that's clear too.

Mike Matson:

Yeah, got it. Okay, all right.

Ron Andrews:

I mean, Mike, we're really trying to give you guys incredible transparency and visibility now. I think it's important given the market environment. We went from $13.3 to $11.3 in operating burn Q1 to Q2. So that was a nice reduction for us based on a lot of stuff we did internally.

We can't do 15% every quarter getting to 10, because we do have a severance charge from the reduction in headcount this quarter as well as we need to bleed off some of these studies. But we're committed to this, we do believe that we've got a line of sight and modest revenue gets us really significant impact on burn next year once the infrastructure costs as we establish new levels.

Mike Matson:

2e. Okay, and then just one on pharma services. It's running, it was like 300,000 or something. Is that a focus for the company? Is that something that can grow into something more material or is it just more, you have some drug companies approaching you wanting to use your tests and you're kind of playing along with that, but you're not really out there actively trying to build that business?

Ron Andrews:

Yes. As part of our reduction in expenses, we did sort of pull back on the commercial. Those are expensive headcount on the commercial effort there. However, we have long-term relationships, most of us, with certain areas within pharma. And we do have two arrangements, one with Qiagen, there's one with Thermo that are long-term contracts to do validation verification, what we call V&D, as well as some development work for them. Those projects will continue.

And the good news for us is we don't really have a dedicated pharma services lab team. This is the lab team that is in R&D in Nashville and R&D here doing things around either IO or doing things around CNI and transplant in Nashville. And so what we do, though, is when we get a project, those folks can flex and perform the pharma project when they need to and when they have time from their activities that they're working on every day because pharma turnaround time is not as essential as a transplant patient turnaround time.

So because we have flexibility there, we're able to get pharma work done with the headcount we already have and it really doesn't mean we have to increase our headcount to grow our pharma business. We do have a nice pipeline over $2 million of pharma service contracts. Our biggest problem is pharma isn't enrolling patients as fast as we need them to so that we can complete our studies and we can bill for it. That's the big challenge we're having right now.

Mike Matson:

Okay, got it. Thank you.

3. Mason Carrico of Stephens:

3a. Hey guys just wanted to ask a couple on DetermaRx here. Great to see the volume growth year over year, but it seems like ASP may have declined sequentially. So I was just hoping to get some color there in terms of what drove the decline and then what your expectations are from an ASP standpoint going forward throughout 2022 and then maybe as we start to get closer to 2023?

Ron Andrews:

Yeah, Mason, thanks for asking that. Because when you just take the raw numbers and divide it by the revenue, it doesn't show the average AUP because we actually do it by billing class, and some of those samples are un-billable. So let me give everyone the breakdown.

In the quarter, about 90% of our volume that was billable was Medicare and Medicare Advantage. Medicare and Medicare Advantage at 90% rendered somewhere around a $3,000 AUP. And about 10% of our samples were commercial samples, meaning that we're not Medicare which means when you blend that AUP in at a much lower AUP, which is somewhere in the $1,800 range, you end up with about $2,972 per case collectible revenue from RX. That is a very solid number for us. We have been tracking that number over time. It's come up in the high $1,800-ish into the low twos and now over $2.5, and now to $2.9.

So we do see that we're getting it. Our challenge is we have a billing backlog, as you might imagine, 'cause it takes us a little while to get some of the commercial payers to pay us. And that billing backlog has increased as we've increased our sample volumes and so that doesn't show up in our AUP, it doesn't show up 'cause the revenue doesn't match the same period as the samples come in. So hopefully that gives you some clarity about the AUP.

Our Medicare, Medicare Advantage samples are consistently coming in around $3,000 and so that is the majority of our revenue push. And so as you think about modeling, obviously, you need to model the commercial payers as well which is much less, but it's not a high percentage. So the product mix or the payer mix right now is really advantageous for us given we're getting such high AUPS for Medicare and Medicare Advantage.

Mason Carrico:

3b. Got it, okay. And then maybe just on the large transplant center that you talked about signing on, and sorry if I missed some of this commentary. But any incremental detail you can give around that maybe the level of volumes they're doing in terms of liver transplants and if there's any stipulation about the number of patients that you're going to be able to capture, and any qualitative or quantitative color you can give there would be helpful.

Ron Andrews:

Yeah, this account probably does somewhere between 300 and 500 livers a year. And I'm not trying to be coy, it's a hyper-competitive environment and we'd like to keep these KOLs under wraps for a while just because they've been so gracious to help us out so much. And we have a number of these that are interested in joining the early adopter program, being part of the program.

So if you think about liver, the utility's going to be different in liver than kidney. You're looking ... you can say about ... if you say they have 300 a year, let's say they need 300 a year, they do probably 500 total transplants, so 300 of those are, I'm sorry, 500 liver cases, about 300 or total transplants.

300 of those a year, if you get two samples or two tests for every liver patient, that's about 600 tests a year, you can start thinking about $2,000 per reimbursed test, that's what kept being harder, 27, 28. You can start to build a case for there's about 70 of these types of centers in the United States.

And so you start to think about liver at, I think around 8,500 liver cases a year, somewhere in that neighborhood and so you got a nice market for liver, but kidney becomes very important to us as well as heart. But, obviously, we have a nice competitive advantage in liver since we're sort of the first out and we have a very rapid turnaround time.

Oncocyte is a precision diagnostics company with a mission to improve patient outcomes by providing personalized insights that inform critical decisions throughout the patient care journey.